KEY POINTS

- Russia and Ukraine are major exporters of food grain, natural gas and metals.

- More than 2,200 U.S. and European based firms have at least one direct supplier in Russia.

- Gas supply interruptions could spur an energy crisis and a further rise to record power prices to consumer energy bills.4

- Russian cyber aggression threatens security collateral damage.

The U.S. stocks market has been hammered for two consecutive weeks as the Nasdaq erases 2.6% and Dow tumbles by 540 points.³ While the implications of the sooner-than-expected interest rate hikes by the Federal Reserve is seen as a big reason for the sell off, stocks has also extended losses as rumors of war persist. The spikes in interest rates could see even higher inflation driven by potential commodity shortages.

Although Russia denies it plans to attack Ukraine, tensions between Russia and Ukraine have spiked in recent months as Russia built up troops along its border with Ukraine. Being strategically located between Russia and the rest of Europe, the possibility of Ukraine joining the EU and becoming a member of the Western military alliance NATO, has received strong opposition from Russia that dates back to 2014 when Russia annexed Crimea from Ukraine.²

“it’s absolutely mandatory to make sure that Ukraine never — never ever — becomes a member of NATO.” Moscow, via Sergei Ryabkov. by Euronews 11/01/2022¹

What Commodity Markets are Most Affected?

Just when it seemed to have eased, it’s now more increasingly possible that the global shortage in semiconductors will likely be extended well into next year. The two countries at the heart of recent tensions, have an outsize impact on a few key commodity markets – some essential to the creation of semi-conductors. Ukraine is a leading exporter of highly purified neon gas, which is necessary for making chips.9

Russia, on the other hand, is the world’s biggest exporter of natural gas and wheat, the second-largest exporter of oil and a top exporter of metals such as aluminum, copper and is the world’s leading producer of palladium, which is essential for many memory and sensor chips.8

The impact on aluminum markets is one of the easiest to see – Aluminum prices have risen about 15% year to date major plus producers such as Alcoa, hit new 52-week highs this week. Russia itself is a large aluminum producer, the country made roughly 3.7 million metric tons of the metal 2021.4

Ukraine was the world’s fifth-largest exporter of wheat. Both countries also account for a large market share or global wheat production. Russia and Ukraine are responsible for a combined 113 million metric tons of wheat annually. Additionally, as it has been in most world conflicts, oil may be at the center of this one as well.4

Russia is a large producer of energy, the country pumps about 9 million barrels of crude oil a day and about 639 billion cubic meters of natural gas in 2021.4 The European Union depends on Russia for around a third of its gas supplies, and U.S. sanctions over any conflict could disrupt that supply. The U.S. government has held talks with several international energy companies on contingency plans for supplying natural gas to Europe if conflict between Russia and Ukraine disrupts Russian supplies.5

More Cyber Attacks on Supply Chains?

Russian has a well know history in cyber aggression. Russia disrupted the Ukrainian electric grid, both in 2015 and the following year, leaving hundreds of thousands of Ukrainians in the cold.7

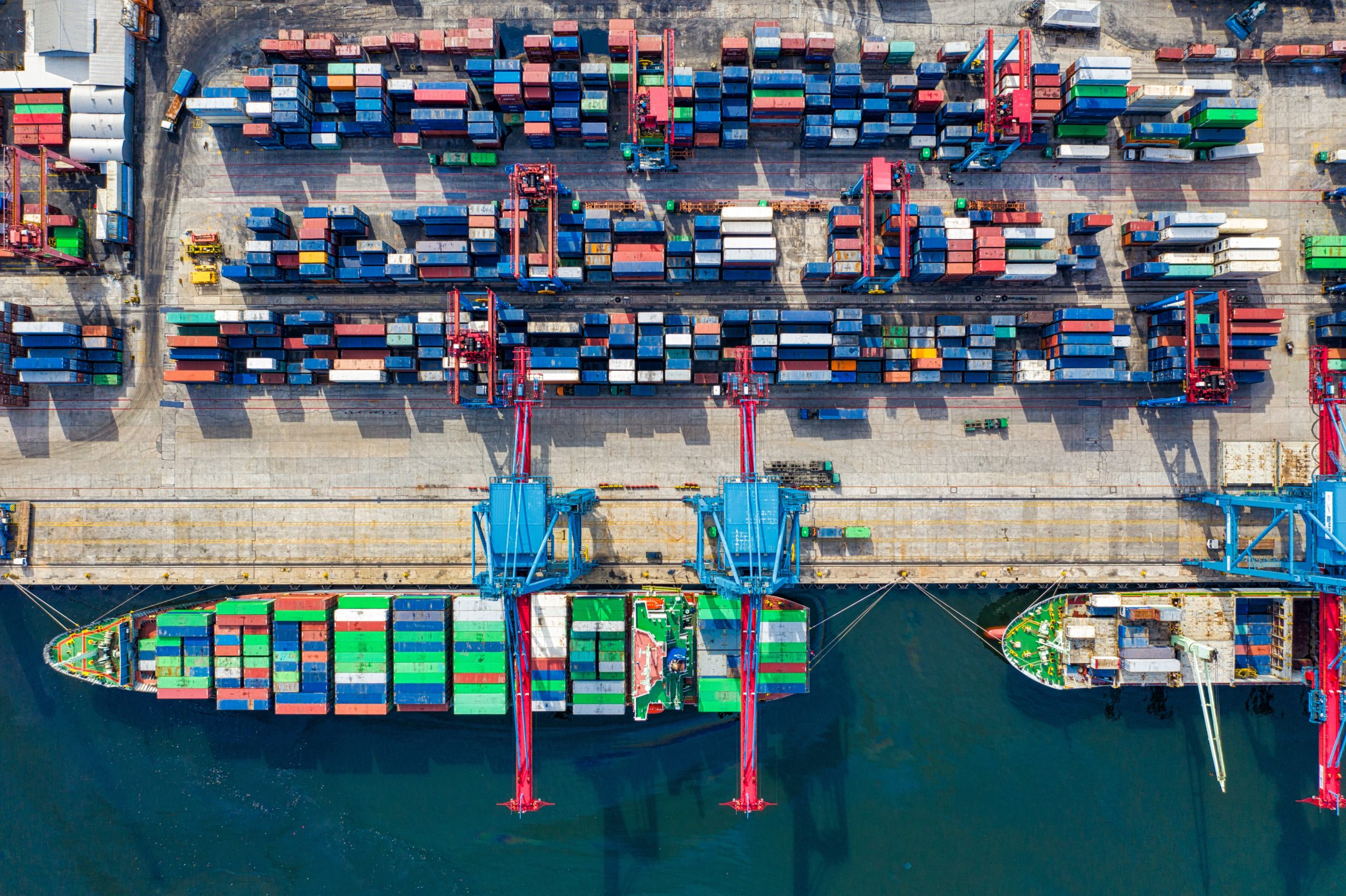

Software and IT services account for around 12% of supplier relationships between U.S. and Russian/Ukrainian companies. The Federal Reserve Bank estimated that victims of the attack, which included companies such as Maersk, Merck and FedEx, lost a combined $7.3 billion.6

Contingency Plans for Supply Chain Leaders Ahead of a Disruption

As suppliers scramble to mitigate supplier risks, GEP recommends “Mapping dependence from the viewpoint of raw material procurement; Create risk profiles of your suppliers; Ramp up cybersecurity – given the threat of cyberattacks from Russia; Increase inventory by estimating your short to medium term demand; Supporting suppliers as well as looking for alternatives; Hedge for commodities and secure ruble and hryvnia currencies to pay local suppliers.”8

Good read. Praying for everyone over there